Budgets

Every two years, the Town of Innisfil develops a budget that identifies the cost of providing the municipal services you rely on every day. This includes roads, traffic signals, streetlights, libraries, parks, emergency services and snow clearing—just to name a few.

To balance the budget, the Town can either:

- Increase user fees, property taxes, and the use of limited reserves OR

- Manage expenses through adapting or reducing the cost of programs and services

2025/2026 Budget

The Town of Innisfil's 2025/2026 budget was adopted on January 29, 2025.

The budget includes a 5.5% residential property tax increase in both 2025 and 2026. This means an annual increase in municipal taxes of $276.88 in 2025 and $292.29 in 2026 for the average household.

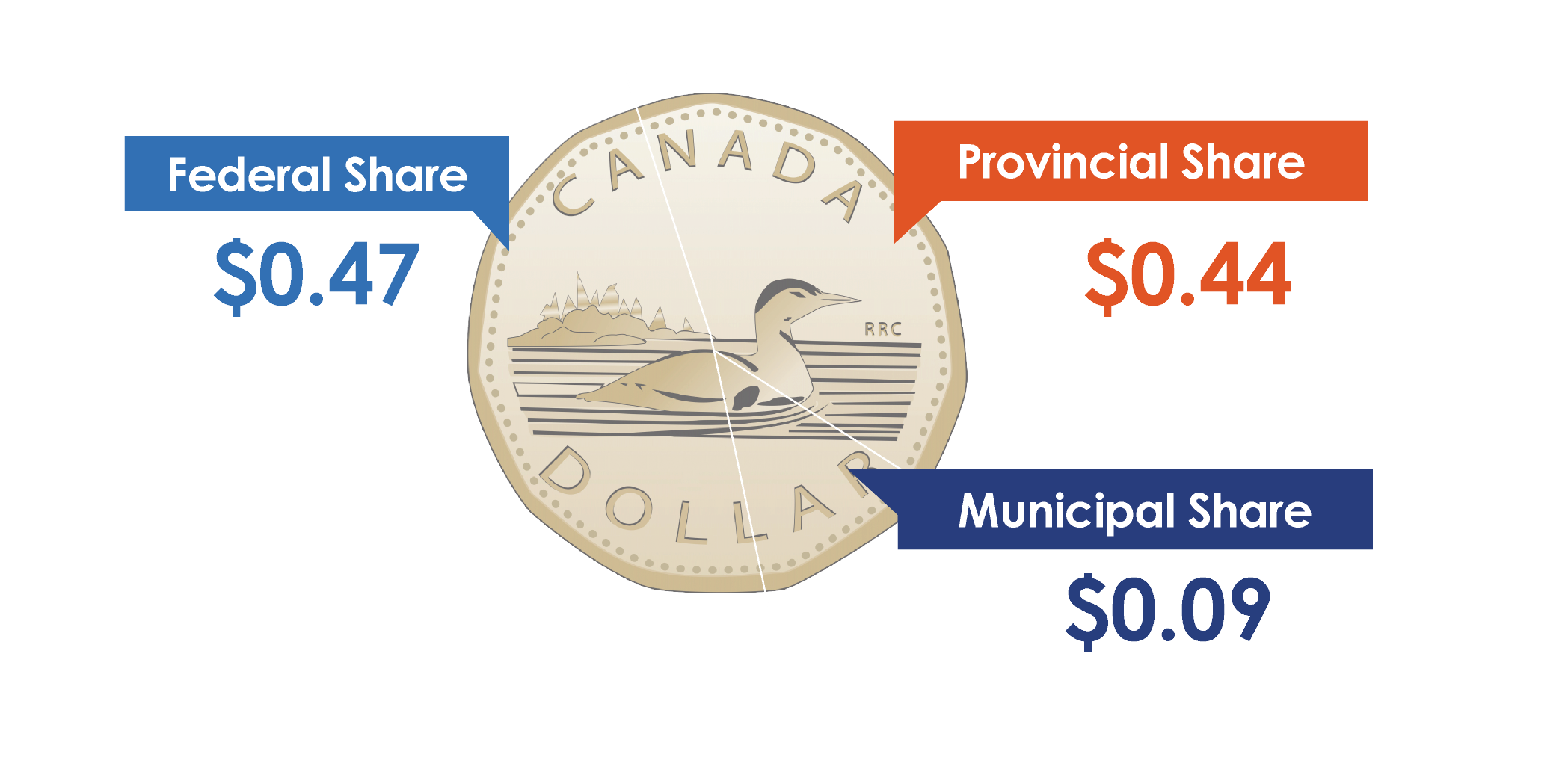

Breakdown of your tax dollar

Your property tax bill may be paid to the Town of Innisfil, but only 50 cents of every dollar stays with us. Part of those funds is the Town's Capital Levy.

The rest goes to the County of Simcoe, South Simcoe Police Service, and the Province of Ontario (education). The County of Simcoe is our "upper-tier" level of government that provides waste collection, paramedic services, long-term care, forestry, social services and more. We have very limited influence over the spending requests we receive from these partners.

|

Supporting budget documents |

|

Budget process |

|

We arrived at the Town's 2025/2026 budget after careful planning, consideration, and deliberation.

|

|

2025/2026 budget engagement |

|

Thank you to all the residents who completed our budget priorities survey. Take a look at the survey summary report to see what was said. Please email us at budget@innisfil.ca with any comments or questions. |

|

Guiding financial policies |

|

The Town's Strategic Plan guides every Town project, initiative and goal, as well as budget planning. We also use these Town financial policies to guide our decision-making when developing the budget:

|

About the budget

The Town prepares two different budgets: the operating budget and the capital budget.

Operating budget

The operating budget is used to keep the municipality running on a day-to-day basis. When you call us to report a problem, pull over for firefighters on their way to a call, or attend a library program, that is the operating budget at work.

| How money is raised | How money is spent |

|---|---|

|

Money is primarily raised through property taxes. User fees help make some programs more self-sustaining such as fees for parking, recreation programs, and facility rentals. |

Money is spent on day-to-day expenses for program and service delivery including:

|

Capital Levy

Just like your car, house or electronic devices, physical municipal assets have a limited lifespan and require ongoing maintenance to extend their life. Eventually, they need to be replaced or discarded. The Town's 1% Capital Levy sets money aside to help pay for the repair and replacement of existing assets, or new assets and projects that aren't eligible for funding from development charges.

Capital budget

The capital budget looks ahead to identify the infrastructure that we need to build and maintain. The budget also includes the financial components of the Town's strategic and master plans.

| How money is raised | How money is spent |

|---|---|

|

New assets are primarily funded through development charges while the repair and replacement of existing assets is funded through the Town's 1% Capital Levy and tax-supported reserves. Other funding sources include OLG funds and grants. |

The capital budget is used to fund new assets, major repairs and replacement of existing assets. Whether we are building a new park, replacing a roof on a building, or repaving a road, this is the capital budget at work. |

Key capital investments in the 2025/2026 budget include:

- Road rehabilitation program - $15M

- New park development - $9.9M

- Annual playground replacement and park redevelopment program - $2.6M

- Lakeside parks program - $4.3M

- Urbanization and intersection improvement of 6th Line (20th Sideroad to Angus Street) - $7.1M

- Drainage improvement program - $6.4M

- Stormwater pond clean-out and retrofit program - $3M

- Continued implementation of our trail program - $1.2M

- Various initiatives to support the Innisfil Economic Development Strategic Plan - $415K

How Innisfil taxes compare

Innisfil taxes are very comparable to other municipalities. In fact, Innisfil is ranked at the “mid” level. According to the 2024 BMA Municipal Study, average property taxes for a single-family home (detached bungalow) in Innisfil were $4,094. Here’s how that number compares to property taxes paid by a similar home in Ontario municipalities with similar populations.

| Municipality | 2024 property taxes |

|---|---|

|

King |

$6,333 |

| Orangeville | $5,076 |

| Aurora | $4,902 |

| Whitchurch-Stouffville | $4,750 |

| Newmarket | $4,596 |

| Georgina | $4,447 |

| Innisfil | $4,094 |

| East Gwillimbury | $4,068 |

| New Tecumseth | $3,973 |

| Orillia | $3,815 |

| Collingwood | $3,708 |

Past budgets

View past Town of Innisfil budgets:

- 2023/2024 Budget and Capital Project Detail Sheets

- 2021/2022 Budget

- 2019/2020 Budget

- 2017/2018 Budget

Please contact us to request budgets for previous years.