Property Taxes

If you own property in the Town of Innisfil, you need to pay property taxes. Review property tax payment options, explore our tax programs and rebates and find out more about how your property is assessed.

Billing

We issue property tax bills twice a year, and each bill is due in two installments. The 2026 interim tax bills will be mailed in late January. Installments are due on the following dates:

- First installment is due Thursday, February 26, 2026

- Second installment is due Wednesday, April 29, 2026

Installments must be paid by these due dates to avoid 1.25% monthly late fees. Please contact us if you don't receive a property tax bill.

View our property tax payment options to find out how to pay. Depending on your payment method, you'll want to send in advance to make sure we receive the payment by the due date.

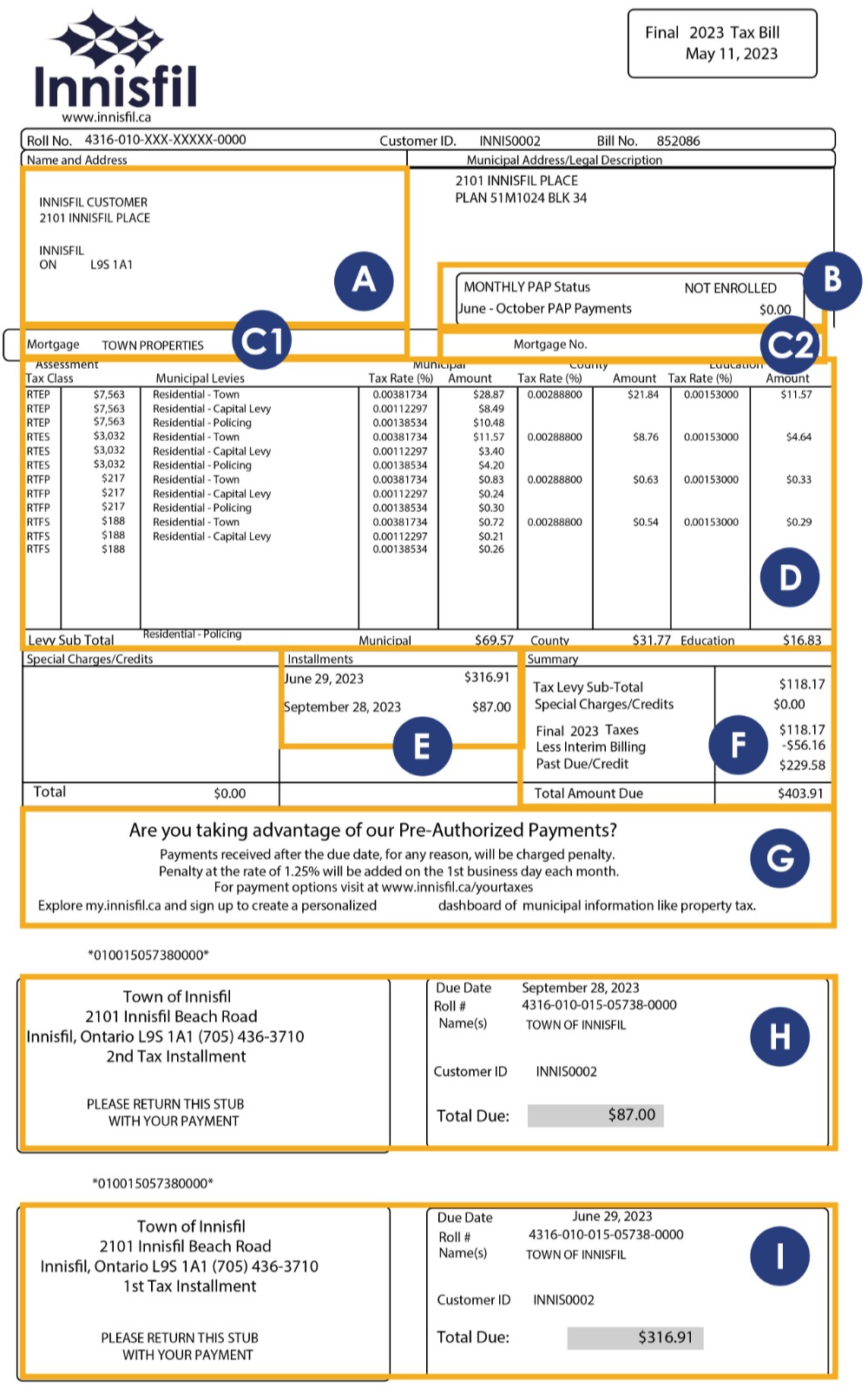

| How to read your tax bill |

|

We've created a graphic to help you read and understand your property tax bill.

Review the labels and descriptions for each area of your bill:

|

| How taxes are calculated |

|

The Town of Innisfil uses property value assessment when calculating property taxes. Your current property assessment is multiplied by the tax rate for your class of property to calculate your property taxes. Watch a video created by the Municipal Property Assessment Corporation (MPAC) to learn more about how your property taxes are calculated. If you're a first-time homeowner, visit MPAC's website to better understand property assessment. |

Sign up for eBilling

You can now access your property tax records 24 hours a day, 7 days a week.

Follow the steps to create an account or sign into your existing account. Review our eBilling Set Up Guide for assistance

Changing your address

If you move, you need to make sure to update your address with us. This way you'll still receive your tax bill on time. Please complete the Change of Address form and submit it by email to finance@innisfil.ca or drop it off or mail it to:

Town of Innisfil

2101 Innisfil Beach Rd.

Innisfil, ON L9S 1A1

Changing your school support

As a property owner in Ontario, you're required to support a school system, even if you don't have children or your children are not currently attending school. For residential properties that are occupied by tenants, the tenants school support preference will supersede that of the owners. There are four different school support options within Innisfil:

- English Public

- French Public

- English Separate (Catholic)

- French Separate (Catholic)

As per legislation, your school support defaults to the English Public school board. However, you may be able to change your school support. If you wish to change your school support, visit MPAC's website for more information.

Tax rates

View the 2025 tax rates for the Town of Innisfil.

| Property class | Town General (%) | Police (%) | Capital (%) | County (%) | Education (%) | Total (%) |

|---|---|---|---|---|---|---|

|

Residential |

0.424843 |

0.156960 |

0.144507 |

0.310357 |

0.153000 |

1.189667 |

|

Farmland Awaiting Development I |

0.318632 |

0.117720 |

0.108380 |

0.232768 |

0.114750 |

0.892250 |

|

Farmland Development II |

0.424843 |

0.156960 |

0.144507 |

0.310357 |

0.153000 |

1.189667 |

|

Multi-Residential/New Multi-Residential |

0.424843 |

0.156960 |

0.144507 |

0.310357 |

0.153000 |

1.189667 |

|

Commercial – Occupied (includes office, parking lots and shopping centre classes) |

0.519286 |

0.191852 |

0.176631 |

0.379349 |

0.880000 |

2.147118 |

|

Commercial – Vacant/Excess Land |

0.519286 |

0.191852 |

0.176631 |

0.379349 |

0.880000 |

2.147118 |

|

Industrial – Occupied |

0.506625 |

0.187175 |

0.172325 |

0.370101 |

0.880000 |

2.116226 |

|

Industrial – Vacant/Excess Land |

0.506625 |

0.187175 |

0.172325 |

0.370101 |

0.880000 |

2.116226 |

|

Pipelines |

0.550851 |

0.203514 |

0.187368 |

0.402409 |

0.880000 |

2.224142 |

|

Farm |

0.1062108 |

0.039240 |

0.036127 |

0.077589 |

0.038250 |

0.297417 |

|

Managed Forest |

0.1062108 |

0.039240 |

0.036127 |

0.077589 |

0.038250 |

0.297417 |

|

Commercial Small Scale – On Farm |

0.129821 |

0.047963 |

0.044157 |

0.094837 |

0.220000 |

0.536778 |

|

Industrial Small Scale – On Farm |

0.126656 |

0.046793 |

0.043081 |

0.092525 |

0.220000 |

0.529055 |